The Baby industry in the 70s was a booming business in Singapore. There were baby shops everywhere, especially in the HDB estates. In the 70s the birth rate had declined compared to the 50s. But with economic growth parents began to invest more in each child, from nursing gear, cloths, furniture and food.

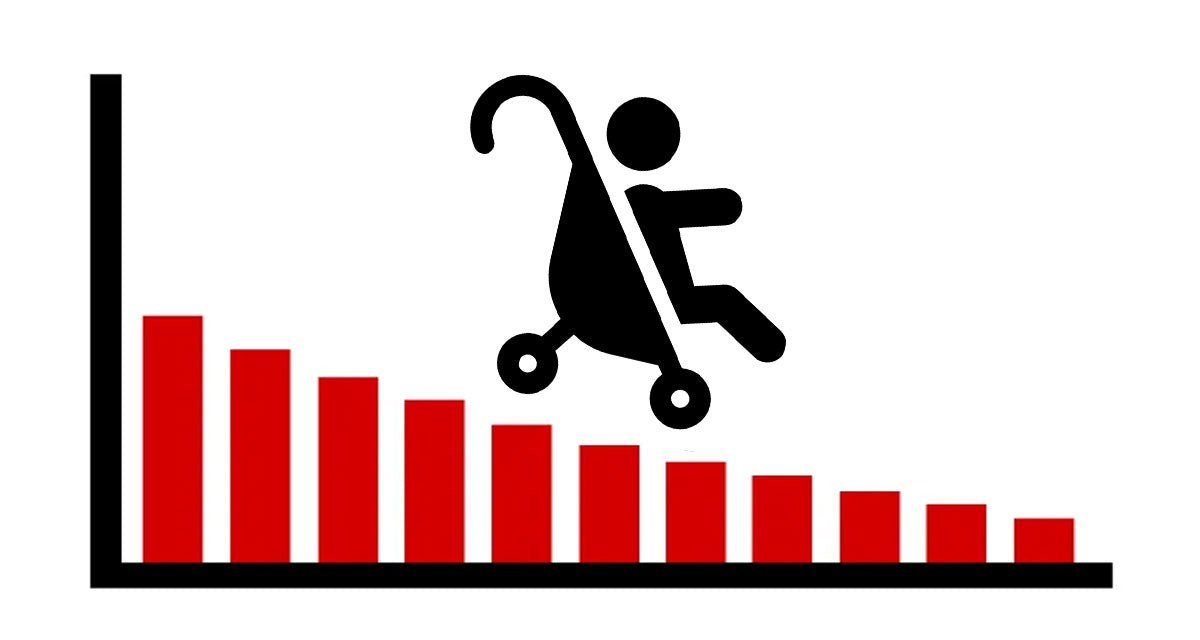

The decline in the industry can be attributed to following reasons

- Declining Birth Rates From Citizens as well as Permanent Residents

- Cross border online purchases through ecommerce marketplaces and overseas ecommerce sites.

- Overseas purchases

- High costs of operations in Singapore

- Dwindling Number Of Dealers

Declining Birth Rates

Channel News Asia reported that Singapore's resident total fertility rate hit an all-time low of 1.05 in 2022, dipping below the previous record of 1.1 in 2020.

| Birth and Fertility | Unit | Period | Latest Data | YOY% Change/21 | Previous Year | YOY% Change/20 |

| Total Live-Births | Number | 2022 | 35,724 | -7.6 | 38,672 | 0.2 |

| Resident Crude Birth Rate | Per 1,000 Residents |

2022 | 8.0 | na | 8.6 | na |

| Resident Total Fertility Rate | Per Female | 2022 | 1.05 | na | 1.12 | na |

From The Department Of Statistics

Singapore's highest births was in 1988, a lunar dragon year, with 52,957 live-births. This year the live births number at 35,724. "This was partly due to the Tiger year in the Lunar calendar. Which is generally associated with lower births among the Chinese," Minister in the Prime Minister's Office (PMO) Indranee Rajah said in Parliament on Feb 24 2023.

The continued decline in birth rates is having a significant impact on the baby market in Singapore. With fewer babies being born, the market for baby-related products and services is shrinking. This is a concern for businesses that rely on the baby market for their revenue.

To address this issue, the Singapore government has implemented various measures to encourage couples to have more children. These measures include providing financial incentives, such as the Baby Bonus Scheme. As well as offering greater support for families, such as more affordable childcare and housing options.

Made For Families Initiative

The "Made for Families" program is an initiative by the Singapore government. It is to promote family-friendly products and services in the country. The program aims to help families make informed choices when selecting products and services. As well as to encourage businesses to develop and offer products that are tailored to the needs of families.

Under the "Made for Families" program, businesses can apply to have their products and services certified as family-friendly. To be certified, the products and services must meet certain criteria, such as being safe for children, providing value for money, and having features that are beneficial to families.

Once certified, businesses can display the "Made for Families" mark on their products and promotional materials. This helps families to easily identify family-friendly options. The program covers a wide range of products and services. This includes food and beverages, household items, transport services, and entertainment options.

In addition to promoting family-friendly products and services, the "Made for Families" program also provides support for businesses to develop and improve their offerings. Businesses can access resources and training programs to help them better understand the needs of families. From there they can develop products that meet those needs.

Overall, the "Made for Families" program is an important initiative by the Singapore government. It helps to promote family-friendly options and support businesses that cater to families. By encouraging the development of family-friendly products and services, the program helps to create a more supportive environment for families in Singapore.

Declining Birth Rates

Despite these efforts, the decline in birth rates in Singapore remains a challenge. It will be important for the government and businesses to continue to find ways to support families. And encourage them to have children in order to ensure the sustainability of the baby market in the future.

It's worth noting that the trend towards female emancipation in Singapore has also had an impact on birth rates. More women are entering the workforce and pursuing their own goals and aspirations. Many are choosing to delay or forego having children altogether.

This has resulted in a declining birth rate in Singapore. Which in turn has significant implications for the baby gear market. As the number of babies being born in Singapore decreases, businesses in this sector may need to adjust their strategies. They need to focus on other consumer segments to remain competitive.

With Singapore's low birth fertility rate of 1.05, it becomes increasingly challenging for businesses to rely solely on the newborn market for repeat business. This has led to a shift in focus towards catering to the needs of parents beyond the newborn stage. For instance, businesses are exploring opportunities in toddler gear and accessories, educational toys, and family-oriented products and services. By diversifying their offerings, businesses can tap into a larger target audience. Hopefully this will increase their chances of sustaining long-term growth in the industry.

Cross Border Online Purchases

The trend of cross-border online purchases has led to a significant decrease in prices for baby gear. This is because consumers are now able to purchase products directly from overseas manufacturers or retailers. This results in cutting out middlemen and reducing costs. Additionally, the increased competition in the online marketplace has forced retailers to lower their prices. Painfully in order to remain competitive.

With the ease of online shopping, consumers can now easily compare prices from different retailers around the world. They can purchase products from wherever they find the best deal. This has put pressure on local retailers to match these prices, resulting in a more competitive marketplace.

The trend has also led to a wider range of products being available to consumers. Previously, consumers may have been limited to the products available at their local stores. But with the internet, they can now access a much larger range of products from all around the world.

However, it is important to note that there are also some challenges associated with cross-border online purchases. Problems such as longer shipping times and potential issues with customs and taxes. Additionally, consumers should be cautious when purchasing products from overseas. As the quality and safety standards may vary from those in their home country. But this is not always true for more well known international brands.

Overall, the trend of cross-border online purchases has had a significant impact on the baby industry. This has led to lower prices and a wider range of products available to consumers.

Overseas Purchases Impact Baby Industry

The ease of overseas travel has made it more convenient for Singaporeans to purchase goods at cheaper prices abroad. Furthermore they benefit from tourist tax refunds. However, this trend has had a negative impact on local businesses, particularly those in the retail sector.

Under Singapore's laws, arriving travellers are required to declare and pay the duty and Goods and Services Tax (GST) to bring in dutiable and taxable goods exceeding their duty-free concession and GST relief. This is applicable whether the goods were purchased overseas or in Singapore.

| Time Spent Away from Singapore | Value of Goods Granted GST Relief * |

|---|---|

| 48 hours or more | S$500 |

| Less than 48 hours | S$100 |

Many Singaporeans take advantage of the opportunity to purchase goods at a lower cost overseas. Bring them back to Singapore in their cars, aircraft luggage or wearing them. As these goods are often used and unpacked, they are not subjected to customs taxes described above. This means that Singaporean consumers can purchase products at a significantly lower price. They would have to pay more if they bought them locally.

Support Singapore And Environment By Buying Local

This has led to a decrease in sales for local businesses, particularly those selling luxury goods and electronics. As consumers have more options to purchase goods overseas, they are less likely to buy from local retailers. This leads to reduced profits, potential job losses in the retail sector and impact the baby industry.

To address this issue, the Singapore government has introduced measures to support local businesses. And encourage consumers to buy locally. These include providing financial assistance and offering tax incentives to local retailers. Additionally, the government has launched campaigns to promote the benefits of buying local. Encouraging consumers to support local businesses.

Despite these efforts, the trend of purchasing goods overseas and enjoying tourist tax refunds is likely to continue. It will be important for local businesses to find ways to adapt and compete with overseas retailers. They need to maintain their market share and continue to provide jobs for Singaporean workers.

High Costs Of Operations In Singapore

The high cost of operations in Singapore is posing a significant challenge to businesses. Especially those involved in the distribution and retail of baby gear and products. The cost of doing business in Singapore, including rent, labor, and other operational costs, is relatively high. This is compared to other countries in the region. This can make it difficult for businesses to remain competitive and maintain their profit margins.

As a result, businesses in the baby industry may struggle to keep prices competitive. Which can lead to reduced sales and lower profits. In addition, the high cost of operations can make it challenging for businesses to invest in research and development. As well as marketing and other areas necessary for growth and innovation.

In response to the challenges posed by the high cost of operations in Singapore, many companies in the country have shifted away from the traditional distribution model. They have started developing their own brands and products. This approach allows companies to have greater control over their supply chain and production processes. This can help to reduce costs and increase efficiency.

The Rise Of Singapore Brands

By developing their own brands and products, companies can also differentiate themselves in the market and create a unique value proposition for customers. This can help to build customer loyalty and increase sales, which can be particularly important in a competitive industry like baby gear and products.

Additionally, developing their own brands and products can help companies to tap into new markets and expand their customer base. By creating products that meet the specific needs and preferences of customers, companies can attract a wider range of consumers and increase their market share.

To support this trend, the Singapore government has launched various initiatives to support innovation and entrepreneurship, particularly in the area of product development. These initiatives provide funding, training, and mentorship to businesses looking to develop their own brands and products.

Additionally the Singapore government has implemented various measures to support businesses, particularly small and medium-sized enterprises (SMEs), in the country. These measures include providing financial assistance, offering tax incentives, and reducing regulatory burdens. Furthermore the government has launched initiatives to support innovation and entrepreneurship, which can help businesses in the baby gear and products sector to stay competitive and grow.

Overall, the shift towards developing their own brands and products is a promising trend for businesses in the baby industry in Singapore. By focusing on innovation and differentiation, companies can overcome the challenges posed by the high cost of operations and build sustainable businesses that can thrive in the global market.

Dwindling Number Of Dealers In Baby Industry

The number of retail baby shops and dealers in Singapore has been dwindling in recent years. Major chains in the baby gear market have reduced their retail footprints by more than 50%, and department stores are also reducing their baby departments. The high cost of retail operations in Singapore has had a significant impact on the baby gear market, with many baby shops being forced to close or diversify their offerings in order to stay afloat. This is particularly true for smaller retailers, who may struggle to compete with larger chains and online retailers.

The number of online dealers has also stagnated, adding to the challenges facing distributors in the market. As a result, some distributors have been forced to sell their products directly to consumers in order to survive, hurting their traditional sales channels in the process.

High Rents For Retail And Warehousing

In addition to high rents and other operating costs, baby shops in Singapore also face intense competition from online retailers and overseas suppliers, who can often offer lower prices and a wider range of products. As a result, many retailers have been forced to explore new business models, such as selling other types of products or focusing on niche markets in order to remain profitable.

Many baby retail shops in the baby industry in Singapore are shifting their focus to clothes and toys with their own brands, as these products tend to provide higher margins than traditional baby gear. This is a smart business move for retailers who are looking to adapt to the changing market conditions and stay competitive. This can be seen clearly in Mothercare and Kiddy Palace stores where clothing and toys dominate the storefront.

Branding Matters

By developing their own brands and offering unique products that can't be found elsewhere, retailers can attract customers who are looking for something different and are willing to pay a premium for quality and exclusivity. This can help to offset the higher costs associated with operating a retail business in Singapore, while also building a loyal customer base that will return to the store again and again.

Cheeky Bon Bon Waterproof Baby Bedsheets

Of course, this strategy is not without its risks, and retailers will need to invest in marketing and branding efforts in order to build awareness of their products and attract customers. However, with the right approach and a commitment to quality and innovation, retailers in the baby gear market can successfully navigate the challenges of the Singapore market and emerge stronger and more competitive than ever before.

Overall, these trends suggest that the baby industry in Singapore is undergoing significant changes and consolidation, with traditional retail channels giving way to new models of distribution and sales. As a result, the role of the middleman is being squeezed. Retailers are also feeling the pressure, with some choosing to buy directly from principals and bypassing distributors in order to improve their margins.

Trends Affecting The Baby Industry

The strict car ownership policy in Singapore has resulted in exorbitant prices for cars, making it unaffordable for many young families. This has had a knock-on effect on the car seat market, as fewer parents are able to purchase cars and therefore do not require car seats. As a result, the demand for car seats has decreased, affecting businesses in this segment.

While the market for car seats may have been negatively impacted by Singapore's car light policy, the market for baby skin care and baby security has increased. Parents are becoming more conscious about the products they use on their babies' delicate skin and are willing to spend more on high-quality, natural and organic baby skin care products.

Maxi Cosi Nomad Car Seat (9 months to 3.5 Years)

Parents are increasingly opting for age-specific toiletries and skin care products for their children, as well as those that offer skin protection. There is also a growing demand for cosmetics that help to nourish and protect infant skin, combat swelling, itching, rashes, and inflammations, and possess antibacterial, antifungal, and antimicrobial properties. As a result, cosmetics and toiletries make up a significant portion of the mother and baby industry, with sales of skin care, hair care, and sun-care protection products increasing steadily.

Demand For Technology

With the surge of women venturing into the labor market, the populace of households with working parents is surging, causing a rise in the frequency of grandparents or babysitters taking care of infants. To tackle this scenario, sophisticated baby-related technology is gaining traction, employing cutting-edge facial recognition tools and artificial intelligence software for remote surveillance of infants. Thanks to technological progress, guardians can now keep a watchful eye on their offspring from any location utilizing intelligent video monitors endowed with two-way audio and various other advanced functionalities. Additionally, the Internet of Things (IoT) has empowered anxious guardians to track their infants' wellbeing, sleeping routines, and even cognitive proficiencies using sensors, applications, cameras, and voice and facial recognition procedures.

Conclusion

In conclusion, foreign or international brand owners and principals who have high expectations from their distributors in Singapore may find themselves disappointed due to the challenges posed by the high cost of operations in the country and low birth rates. Instead, focusing on the larger ASEAN countries with much high birth rates and larger populations may be a wiser move for these brands.

However, it's important to note that the ASEAN market is not homogenous and what works in Singapore may not necessarily work in countries like Vietnam or the Philippines. Each country has its unique cultural, economic, and regulatory landscape, which can affect the success of businesses in the baby industry.

Therefore, it's crucial for foreign or international brands looking to expand into the ASEAN market to conduct thorough market research and understand the specific needs and preferences of consumers in each country. By doing so, they can tailor their products and marketing strategies to better appeal to local customers and increase their chances of success.

Distributors' Problems Mounting

To aggravate matters even further many foreign or international principals create challenges for their distributors in Singapore by offering conflicting channels. For example, some principals may sell their products directly to consumers through online marketplaces such as Amazon, offering lower prices than their local distributors.

This can put distributors in a difficult position, as they are expected to provide high levels of service and support to customers, even when they are unable to compete on price. In some cases, principals may offer excuses or place the burden on distributors to provide better service, despite the challenges they face in the marketplace.

Overall, while the Singapore market may present challenges for local owned businesses in the baby gear and products sector, there are still opportunities for growth and innovation. By focusing on product development, cost management, and differentiation, companies can overcome these challenges and build sustainable businesses that can thrive in the ASEAN market.

Source: by Angela Sim